michigan gas tax rate

52 rows The current federal motor fuel tax rates are. Michigan Gas Tax Michiganders currently pay a gas tax of 2630 cents per gallon.

Animation Animated Gif Gif Greenhouse Gases Convection

The tax on regular.

. 100 of gross cash market value. Gasoline 263 per gallon. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

Call center services are available from 800am to 445PM Monday Friday. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01. Natural gas prices as filed with the Michigan Public Service Commission.

Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles. The Michigan state sales tax rate is 6 and the average MI sales tax after local surtaxes is 6. Michigan drivers pay 42 cents per gallon in state gas taxes.

MiMATS users should continue to use the MiMATS eServices portal. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St. 100 of gross cash market value.

Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers. Hamilton Senior Fiscal Analyst. 1 2017 as a result of the 2015 legislation.

Oil Gas Fee. Michigans maximum marginal income tax rate is the 1st highest in the United States ranking directly below Michigans. Michigan Alcohol Tax Beer wine and liquor are taxed at different rates in Michigan.

It will have a 53 increase due to a rounding provision specified in the calculations. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Gasoline 19 per gallon.

Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST. COVID-19 Updates for Michigan Motor Fuel Tax. Michigan levies a 19-cent-per-gallon tax on gasoline and a 15-cent-per-gallon tax on diesel motor fuel.

The tax for diesel fuel is the same. Effective October 1 2020 through October 31 2020 the rate for gasoline was established at 107 cents per gallon and the rate for diesel fuel was established at 122 cents per gallon. These tax rates are based on.

Information on natural gas service and rates for residential customers in Michigan. Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers. Sales tax exemption Sales and use tax exemptions for energy used by some nonprofit and governmental organizations agricultural producers industrial processors and businesses with residential electric use.

For fuel purchased December 31 2016 and before. These taxes levied under the. 0219 gallon Most jet fuel that is used in commercial transportation is 044gallon.

Currently Michigans fuel excise tax is 263 cents per gallon cpg. For fuel purchased January 1 2017 and after. How a rate review works.

2021 michigan gas tax rate Call center services are available from 800am to 445PM Monday Friday. Diesel Fuel 263 per gallon. 2021 Michigan state sales tax.

Didnt gas taxes just go up. Michigan collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Compressed Natural Gas CNG 0184 per gallon.

The same three taxes are included in the retail price on. This rate will remain in effect through February 28 2022. Per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon.

Prepaid Diesel Sales Tax Rate. Michigan fuel taxes last increased on Jan. Michigan House and Senate Republicans reached a legislative compromise this week on a 25 billion proposal to cut the states income tax rate while creating new tax credits for.

Groceries and prescription drugs are exempt from the Michigan sales tax. 100 of gross cash market value. Purchases of gasoline and diesel motor fuel in Michigan are subject to several different taxes.

100 of gross cash market value. Counties and cities are not allowed to collect local sales taxes. Beer is taxed at a rate of 20 cents per gallon.

LPG 15 per gallon. This tax is established in the Motor Fuel Tax Act 2000 PA 403. Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale tax rate most areas Other Tax include a 005 cpg Petroleum Test Fee gas onlyand a 030 cpg spill fee State excise tax is 8 cpg on gasoline and diesel Petroleum Business Tax 178 cpg gas only and 1605 cpg diesel article 13A.

Unlike the Federal Income Tax Michigans state income tax does not provide couples filing jointly with expanded income tax brackets. Motor Fuel Taxes Sales Tax on Motor Fuels and Methods of Tax Collection. Recent historical sales tax prepayment rates for gasoline and diesel fuel as applicable are set forth below.

51 rows Gas tax is different for gasoline diesel aviation fuel and jet fuel. Motor Fuel Tax Return filing deadlines have not changed. Diesel Fuel 15 per gallon.

Exact tax amount may vary for different items. Under the governors proposal a 45-cent increase would occur in three. The current state gas tax is 263 cents per gallon.

Effective February 1 2022 the new prepaid gasoline sales tax rate is 182 cents per gallon. Effective February 1 2022 the new prepaid gasoline sales tax rate is 164 cents per gallon. Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on unincorporated businesses.

Michigan natural gas rates.

Infographic The Worst Oil Spills In History Oil Spill History Infographic World Oil

Fiat Chrysler To Put 1 Billion Into U S Jobs And Revive Jeep Wagoneer Chrysler Fiat Michigan

Pin On Irs Tax Debt Relief Tax Settlement

United States Of Beer For Americans Who Partake In Alcohol Beer Is Still Drink Of Choice Vivid Maps Map Alcohol United States Map

A New Map Courtesy Tax Foundation Shows Where Pennsylvania Stacks Up On State Gas Taxes For More O Infographic Map Safest Places To Travel Best Places To Move

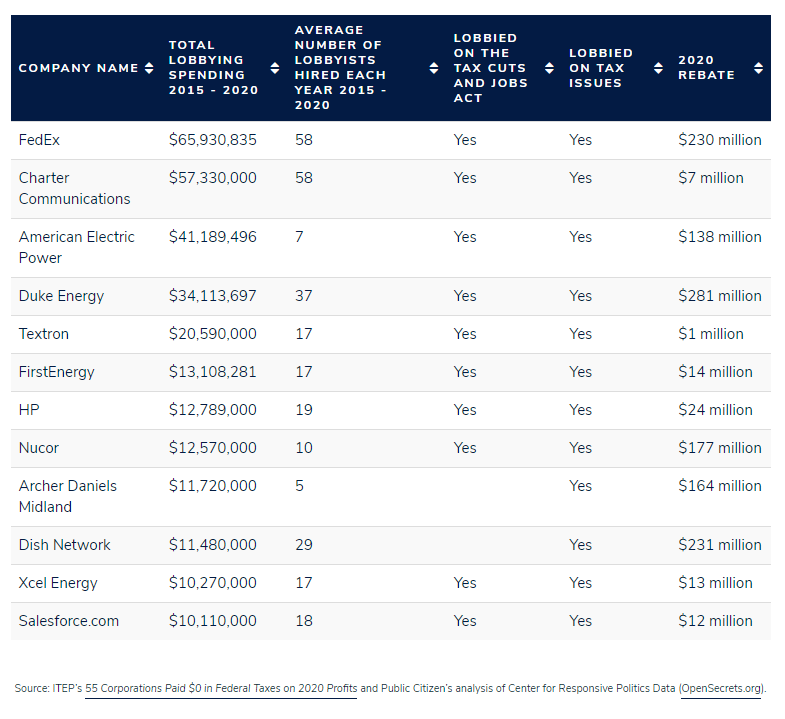

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

The Case For Biden S Tax Agenda Itep

Wsj News Graphics Wsjgraphics Twitter Charts And Graphs Information Graphics Graphic

Driving Through Gas Taxes Carbontax Undergroundstoragetank Map Gas Tax Best Airfare Deals

Michigan Lottery Victoria Leblanc Wins 100 000 In 2021 Florida Lottery Lottery Winning The Lottery

Tire Size Chart Conversion Metric To Inches Tractor Tire Conversion Chart 751 880 Of Pictures Tyre Size Tractor Tire Chart

Cis 1111 Programming Sleeping Bear Dunes 2d Arrays Solved Ankitcodinghub Solving Programming Tutorial Sleeping Bear Dunes

We Borrow From China To Subsidize These Takers Know That Walmart St Joseph Michigan Online Special

Live Dealer Software Developers For Gamstop Users Software Development Development Casino Table Games

Conventional Loan Rates Conventional Mortgage Mortgage Loans Conventional Mortgage Loan

Tobacco Cigarette Tax By State 2020 Current Rates In Your Jurisdiction